It is expected that stock market investors would take on some level of risk in exchange for a potential gain. It would be best if you could anticipate a return on your investment in stocks that is proportionate with the level of risk you're taking. Earnings should increase in proportion to the level of risk taken. The issue with weighing risk against reward is that the payoff is always hypothetical. Gains from investments are not instantaneous and are never 100% certain. To make informed investing decisions, traders need a method to predict how much they can expect to gain from a given trade. If you'd want to get a feel for the possible payoff of an investment or the degree of risk you're engaging in, there's a simple method to do it.

The Market's Default Risk Premium

The market risk premium seems to be the average return less the risk-free rate. When discussing stock exchanges, "the market" might refer to the whole S&P 500 or Dow Jones Industrial Average. Systematic risk refers to the dangers inherent in the market. On the other hand, uncertainty relates to the chances of a single investment and is unrelated to the market across the board. A diversified portfolio brings the risk level closer to the market average. The various cliches about diversifying your investment portfolio come from the relationship between unsystematic and systematic risks but instead returns.

Using Capm, The Risk Premium On A Stock

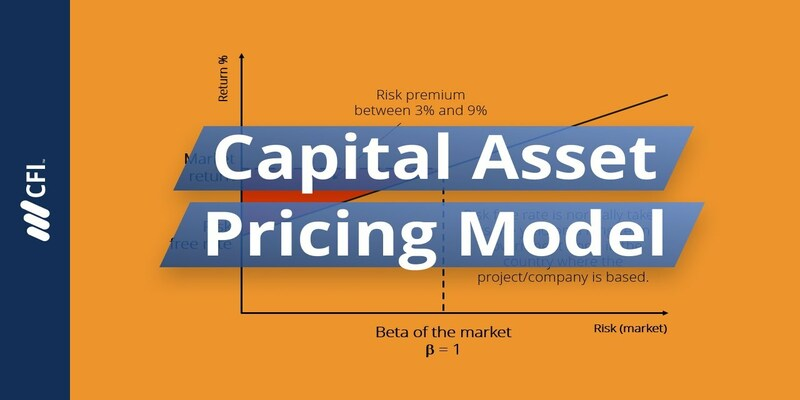

And using the capital asset valuation model, the overall risk premium of a given investment is calculated as beta times the spread between the market return and the risk-free rate. The market risk premium may be calculated as follows: return on the market minus return on a risk-free investment. The CAPM may be reformulated from this data as

The Risk-Free Rate Of Return

Find out the market's risk-free return on investment before investing. The rate you're comfortable with should be determined by the rate of return you may expect to earn on some risk-free transactions. Since U.S. Treasuries are backed by the complete confidence and credit of something like the U.S. government, the probability of default is very low, and the return is nearly guaranteed. Using a 2% return using Treasury bonds as a floor can help you plan for the future. Risky investments must provide a return of at least 5% a year in interest, capital appreciation, or a combination of the two to be considered profitable. An investment's risk premium has always been its rate of return, expressed as a percentage, over the risk-free rate of return, which is typically 2%.

Is It Sufficient?

It would be best if you considered whether or not a 9% risk premium is sufficient for the risk of a specific asset when making investing decisions. There is a chance that the stock you are considering may underperform the market. Although potentially lucrative, investments in a fledgling, small-cap stocks may not provide a substantial enough risk premium to warrant the potential reward.

The Premium For Risk Conclusion

Keep the following in mind as a quick review of what risk premium represents, why it's employed, and how it's calculated:

- To calculate the risk premium, subtract the expected return on a risk-free investment from the total return.

- The average market return minus the risk-free rate equals the market's risk premium.

- When discussing stock prices, the term "market" may refer to either the total value of an index like the S&P 500 or the value of a single stock.

- Systematic risk is another name for market risk. In contrast, unsystematic risk refers to the uncertainty surrounding a single investment rather than the whole market.

- And using the efficient market hypothesis, the risk premium for such a given investment is calculated as beta multiplied by the spread between the market return and perhaps the risk-free rate of return.

Conclusion

This basic test may not capture additional elements affecting the investment's success. The takeaway is that before putting your money into any stock (or any other asset), visitors should evaluate whether or not the risk premium is sufficient to warrant the potential reward. There's also something that defies numerical quantification. Thinking about how comfortable you are with danger is also essential. To make some investments, you may need a significantly higher risk premium than 9%, or you may want to stick to relatively safe, conservative options with low-risk tips. Successful investment requires knowing how much risk you are willing to take.